Accounting Equation: What It Is and How You Calculate It

Successful investors look well beyond today’s stock price or this year’s price movement when they consider whether to buy or sell. Get instant access to video lessons taught Accounting Security by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. But an important distinction is that the decline in equity value occurs due to the “book value of equity”, rather than the market value.

- Note that stock dividends, however, don’t change the total shareholders’ equity; they just move value from retained earnings to paid-in capital within the equity section of the balance sheet.

- However, many analysts use equity in conjunction with other financial metrics to gauge the soundness of a company.

- This is usually one of the last steps in forecasting the balance sheet items.

- The retained earnings are used primarily for the expenses of doing business and for the expansion of the business.

- At some point, the amount of accumulated retained earnings can exceed the amount of equity capital contributed by stockholders.

- The result helps determine how stable a company and its financial health are.

- Short-term debts generally fall into the current liabilities category, as these are things that a company is most likely to pay in the near future.

Date In A Letter ( Guide: Formal Letters And In Business)

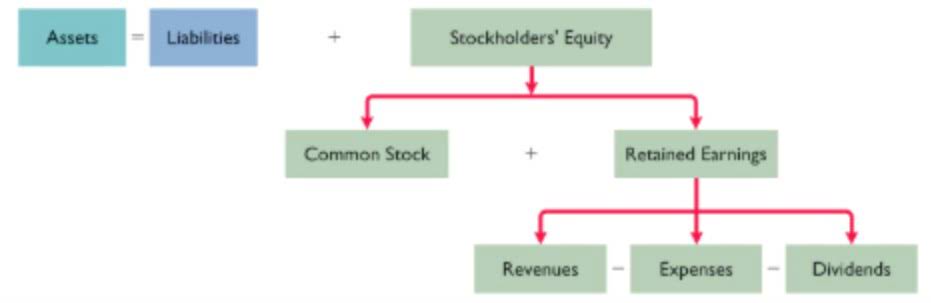

- To calculate stockholders’ equity, you can use one of two accounting equations.

- A sustainable and increasing ROE over time can mean a company is good at generating shareholder value because it knows how to reinvest its earnings wisely, so as to increase productivity and profits.

- Further, the Shareholder’s purchase of company stock over a period gives them the right to vote in the board of directors elections and yields capital gains for them.

- From the beginning balance, we’ll add the net income of $40,000 for the current period, and then subtract the $2,500 in dividends distributed to common shareholders.

- Whether negative stockholder’s equity is indicative of a larger problem usually requires taking a closer look at the company’s financials.

- Companies can reissue treasury shares back to stockholders when companies need to raise money.

The par value of issued stock is an arbitrary value assigned to shares in order to fulfill state law. The par value is typically set very low (a penny per share, for example) and is unrelated to the issue price of the shares or their market price. The following examples feature the shareholders’ equity statement and show how to calculate shareholders’ equity with respect to all the above-mentioned components.

SS4 Form (What It Is And Why It’s Important: All You Need To Know)

Stockholders’ equity is a measurement of the general financial health of the company. If the number for stockholders’ equity is negative, it may warn of impending bankruptcy (particularly if it is due to a high debt load). Simply put, with ROE, investors can see if they’re getting a good return on their money, while a company can evaluate how efficiently they’re utilizing the firm’s equity. ROE must be compared to the historical ROE of the company and to the industry’s ROE average – it means little if merely looked at in isolation. Other financial ratios can be looked at to get a more complete and informed picture of the company for evaluation purposes.

Stockholders’ Equity and the Impact of Treasury Shares

Although many investment decisions depend on the level of risk we want to undertake, we cannot neglect all the key components covered above. Bonds are contractual liabilities where annual payments are guaranteed unless the issuer defaults, while dividend payments from owning shares are discretionary and not fixed. A company’s equity position can be found on its balance sheet, where there is an entry line for total equity on the right side of the table. The $66.8 billion value in company equity represents the amount left for shareholders if Apple liquidated all of its assets and paid off all of its liabilities. Subtracting liabilities from assets, we see that shareholders’ equity was therefore $66.8 billion ($331.2 billion -$264.4 billion).

Where to Find Data for Company Equity

- The BVPS formula is total equity less preferred equity divided by total shares outstanding.

- Stockholders’ equity comprises several components, including share capital, retained earnings, treasury stock, and other comprehensive income.

- The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest.

- Understanding stockholders’ equity and how it’s calculated can help you to make more informed decisions as an investor.

The stockholder’s equity can be calculated by deducting the total liabilities from the company’s total assets. In other words, the Shareholder’s equity formula finds the net value of a business or the amount that the shareholders can claim if the company’s assets are liquidated, and its debts are repaid. Current obligations are debts that must be repaid within one year (e.g. accounts payable and taxes payable). Long-term liabilities are obligations that must be repaid over a period of more than a year (e.g., bonds payable, leases, and pension obligations).

You can calculate shareholders’ equity using the basic Accounting Equation or the Investor’s Equation. Even though the financial models can be quite complex, the shareholder equity will fundamentally be calculated the same way. As a result, if dividends are paid, the shareholder equity value will decrease.

Small Businesses

- A year-end number is arrived at by using return on equity (ROE) calculation.

- While the simple return on equity formula is net income divided by shareholder’s equity, we can break it down further into additional drivers.

- While it’s not an absolute predictor of how a stock might perform, it can be a good indicator of how well a company is doing.

- Companies buy back their stock for various reasons, like boosting share prices or consolidating ownership.

- A riskier firm will have a higher cost of capital and a higher cost of equity.

- If a balance sheet is not available, another option is to summarize the total amount of all assets and subtract the total amount of all liabilities.

Shareholders equity is the value obtained by taking a company’s total how to find stockholders equity balance sheet assets less total balance sheet liability. Let’s look at Apple Inc’s consolidated balance sheet to calculate its shareholders equity. The Return on Equity is essentially a company’s net income divided by the shareholders equity.

A dividend payable account is used by the corporation to record the obligation to pay a dividend once it is declared by the board. It represents the total profits that have been saved and put aside or “retained” for future use. The amount of equity one has in their residence represents how much of the home they own outright by subtracting from the mortgage debt owed. Equity on a property or home stems from payments made against a mortgage, including a down payment and increases in property value.

Corporate and Business Entity Forms

In order to determine the equity of the shareholders, let’s use the company ABC Ltd as an example. Determine the company’s shareholder equity based on the provided information. You can also consider the shareholders equity to represent a company’s residual value left to stockholders once all the company’s assets are liquidated, business creditors and company debt are fully paid. By extracting the total assets and liabilities information from a company’s financial statements, you can calculate shareholders equity. Equity is also known as shareholder’s equity and is easily available as a line item in the balance sheet. It is the amount received by the shareholders if we liquidate all accounting the company assets and repay all the debt.